portability estate tax definition

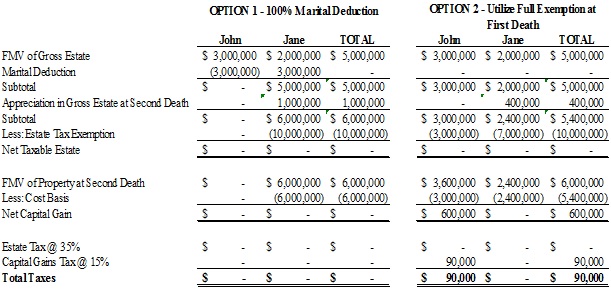

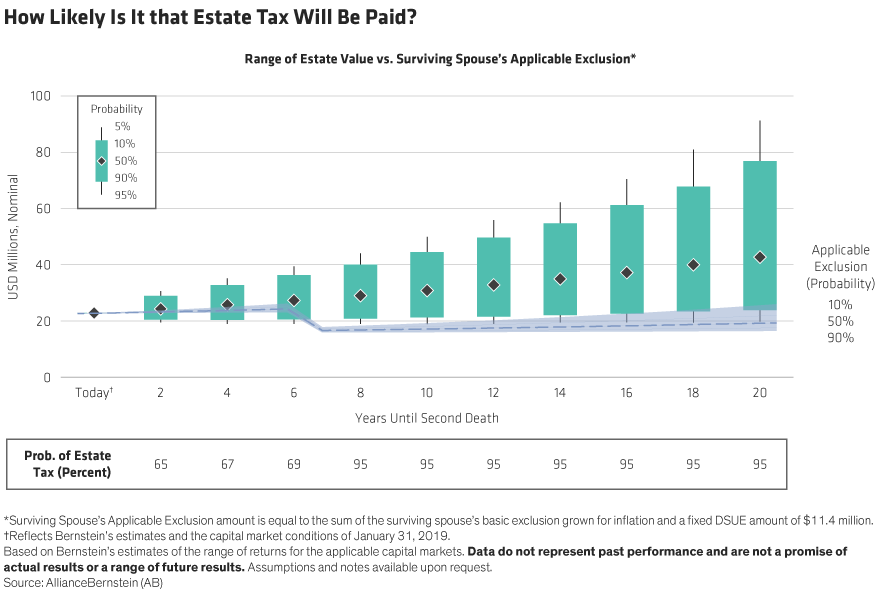

Now married couples may use portability to add any unused portion of the estate tax exemption of the first spouse to die to the surviving spouses estate tax exemption. The Estate Tax is a tax on your right to transfer property at your death.

Mastering Portability Ultimate Estate Planner

Definition of Portability of the Estate Tax Exemption So what does portability of the estate tax exemption mean.

. The surviving spouse can then use his or her own unified credit on additional assets that can pass to children and grandchildren free of gift andor estate tax. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax. It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away.

The one thing that remained unchanged was portability estate tax. If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six. Sim ply put portability is a way for spouses to combine their exemption from estate and gift tax.

The portability election is. The temporary regulations require than an executor include a computation of the DSUE amount on the decedents estate tax return in order to allow portability of that. The exemption is subtracted from the value of estate assets with the result being subject to the estate tax.

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. Portability is the ability to move a certain amount of money that can be left to others tax-free for estate planning purposes as described by WMUR9s article Money. More specifically its a process where a surviving spouse can pick up and use the unused.

Estate tax portability means that the unused portion of the first-to-die spouses estate tax exemption passes to the surviving spouse. Thanks to portability the surviving spouse can use the deceased. Portability Estate Tax Definition.

Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his. The 2 portion is an amount equal to the amount of the tentative estate tax on 1 million plus the applicable exclusion amount in effect minus the applicable credit amount in effect. Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption.

Since the TCJA Tax Cut Job Act was passed in 2017 things have changed with respect to estate tax planning and gifts. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. In this example that is nearly 8 million.

In simple terms portability of the federal estate tax exemption between. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The current estate tax exemption is.

The key is to file for estate tax portability on time. The estate tax portability rules save your estate from almost being cut in half when sent to your heirs.

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

New Irs Requirements To Request Estate Closing Letter

What Is Portability Burner Law Group

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Will Your Estate Be Taxable In The Future Context Ab

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Exploring The Estate Tax Part 1 Journal Of Accountancy

Exploring The Estate Tax Part 2 Journal Of Accountancy

Credit Shelter Trusts And Portability Eagle Claw Capital Management

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Credit Shelter Trusts And Portability Eagle Claw Capital Management

What Is An Estate Tax Napkin Finance

What You Need To Know About The Final Estate Tax Portability Rules

Estate Tax Current Law 2026 Biden Tax Proposal

Estate Tax Net Will Widen Considerably In 2026 The Oakley Law Group

Form 706 Extension For Portability Under Rev Proc 2017 34

This Strategy Can Double Your Estate Tax Exemption Investmentnews

Cibc Private Wealth Management Estate Planning Fundamentals Modern Families Page 1